%

Budget Increase

Increase in CAC

%

Increase in Return On Investment

A local home services client saw leads and follow-on revenue dip during the most recent period, despite coming off multiple months of robust growth. As a media-driven entity, this lead generation company’s advertising metrics appeared to be moving in the right direction. Further, though marginally influenced by weather, such factors were favorable in the cycle. While demand for services dropped in the period, other performance metrics such as average ticket price and close rates remained strong and in line with expected performance.

Broader industry characteristics also suggested no reason for the downturn in business. During the recent COVID-19 pandemic, the performance of home services sector had seen prodigious growth and success relative to other B2C businesses and indeed this client was largely deemed a “COVID Winner”. The company clearly had a lead generation issue.

The Challenge

Traditional media, including television and radio, enjoyed improved media effectiveness with advantageous CPMs due to the efforts of Scale’s media buying teams.

Paid search efforts were performing at consistent and acceptable cost per acquisition rates, though volumes had fallen off in branded search terms.

Programmatic Facebook advertising had recently changed from a ‘Reach’ strategy with focus on optimization toward the lowest cost of ad impressions, to a ‘Conversion’ strategy which optimized against Facebook-measured acquisition costs.

In the Reach campaign, the Facebook acquisition cost was over $2XX per lead. With the new Conversion campaign, now several months running, that Facebook acquisition cost had been cut nearly in half.

By all accounts the media performance looked to be strong. So what was wrong? Where were the leads?

Scale’s Capabilities

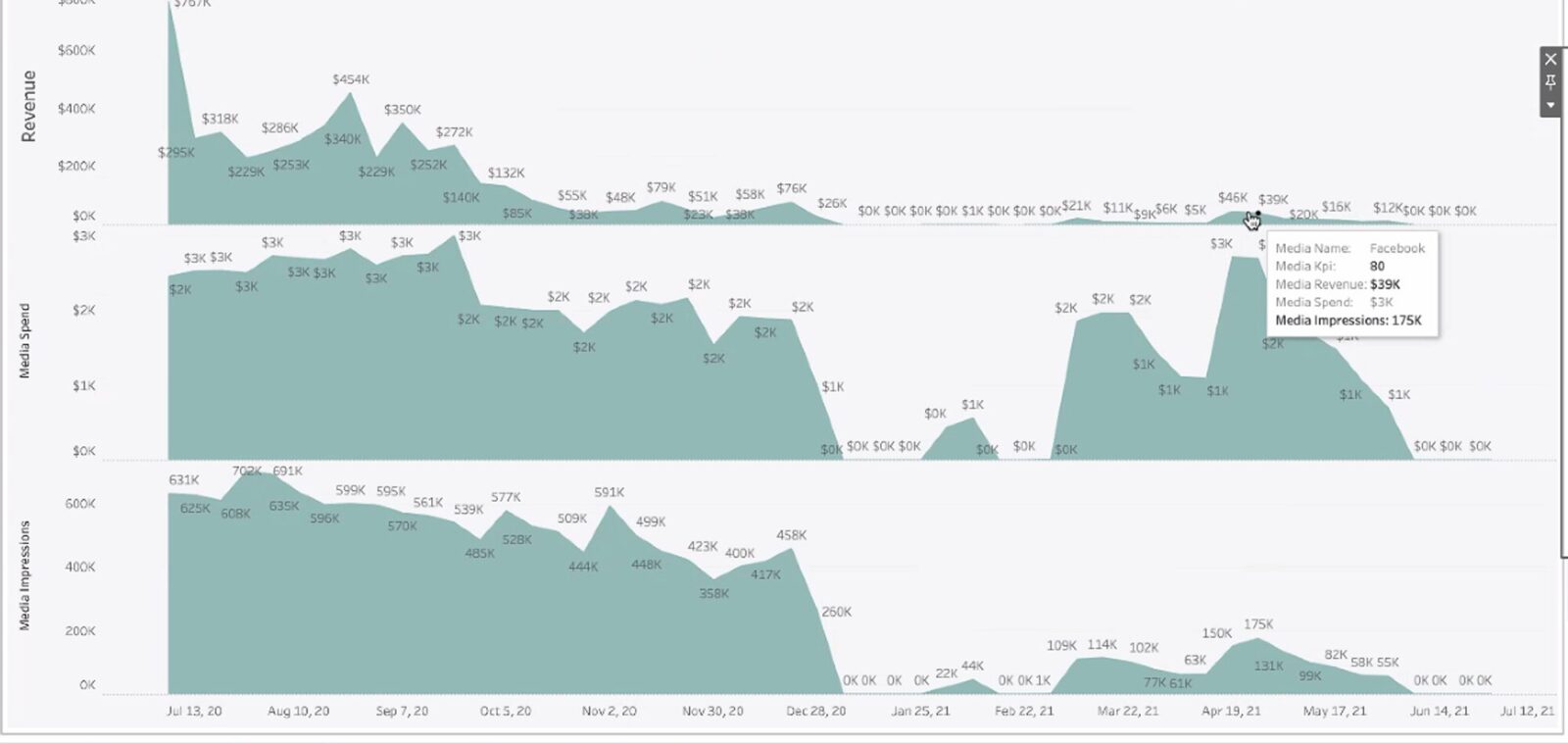

Scale Marketing’s proprietary Media Mix Modeling tool, Attribution to Optimization Modeling (ATOM) was run against the most recent quarter. ATOM provides an understanding of the contribution for each medium relative to its optimal potential against a business KPI.

Surprisingly, despite the massive improvement in the Facebook cost of acquisition, ATOM’s assessment of the contribution by Facebook had dropped dramatically by a factor of more than 45%.

A deeper dive revealed that as the Facebook campaign optimized toward Conversions, the number of impressions in the market had dropped by more than 80% against similar budgets.

Could it be that cheaper, less targeted impressions were more valuable for the client than impressions specifically optimized to customer conversion?

The Outcome

A hypothesis was formed that despite the improvement in linear, bottom-of-the-funnel performance, the business was suffering due to the lack of overall impressions in the marketplace. Scale decided to run a stratified Facebook A/B geo test with two disparate campaigns: Reach vs Conversion.

The results were conclusive. The Reach campaign show a 12% lift in the KPI vs the same expenditures for the Conversion campaign.

On the surface, the move to a Conversion approach for Facebook made perfect sense. A cheaper lead cost must be positive, and linear results backed up that notion. However, the lost upper funnel impressions had a dramatic but unseen negative impact. ATOM provided analytical insights that allowed Scale to understand the true contribution of impressions and revert to a Reach strategy with Facebook.

With ATOM, Scale was able to make timely strategic adjustments to get the client back on track — saving valuable time and money.

Contact Us

We’d love to talk and understand your business.