As the television landscape is undergoing a profound transformation, traditional (linear) TV advertising stands at a critical crossroads. It’s facing significant challenges. But it’s also revealing unexpected resilience and adaptation strategies.

At Scale Marketing, we’re keying in on three major shifts that could affect your 2025 marketing strategy:

- Linear TV (encompassing broadcast and cable) audiences are slowly eroding.

- The connected TV and ad-supported streaming audience is growing.

- Advertisers are figuring out how to track viewers across different platforms.

Trends in Viewership

Traditional TV continues to experience a steady viewership decline as some people continue to cut the cord. Ad dollars continue to shift toward digital advertising platforms. However, linear TV maintains relevance in the following areas:

- 72% of adults still engage with broadcast and cable TV monthly.

- Live sports remain a cornerstone of viewer engagement.

- Older demographics represent a consistent linear TV audience.

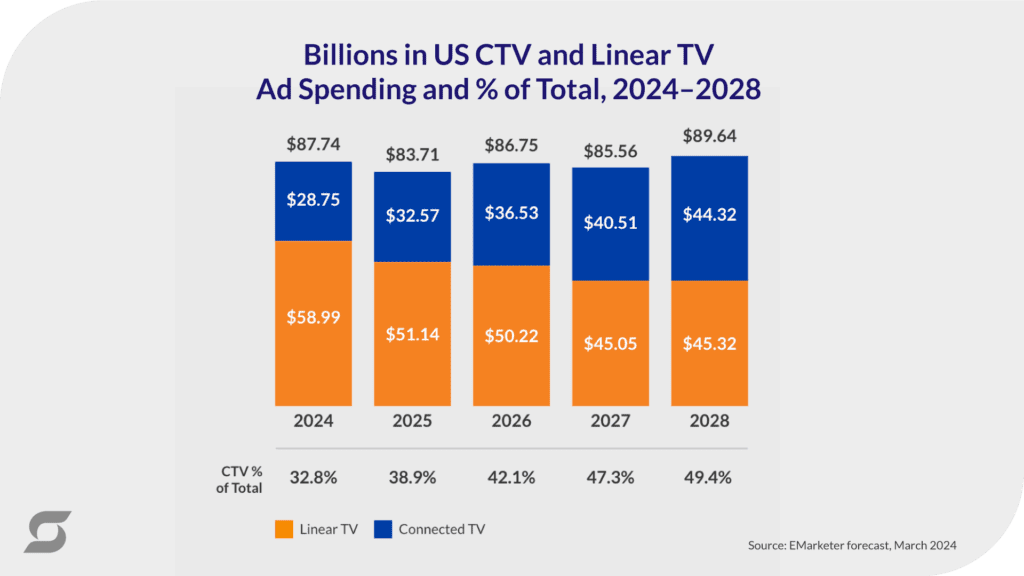

- Projected linear TV ad spending will decrease by 13%, reaching approximately $51 billion.

Despite challenges, linear TV is evolving through new measurement technologies and higher-quality content to stay relevant in the changing media landscape.

Marketers Must Strategically Adapt

Experimentation and staying up to date in the new environment is key. TV viewership may be declining, but it still draws a huge audience, especially for live sports and news. TV (broadcast + cable) still reaches nearly 72% of persons 18+ on a monthly basis (source: Nielsen).

Projected Decrease in Spending in 2025

The 2024 election cycle is in the rearview mirror. Projections say linear TV spending in 2025 will decrease by over 13% to just over $51 billion.

As linear TV impressions continue to decrease, marketers should be mindful to adjust rates so CPMs align with the shifting audience size. Continuing to pay the same rates for fewer impressions won’t deliver effective outcomes.

Additionally, advertisers should understand that a decline in TV impressions could necessitate a higher investment in digital platforms like CTV to bridge the gap.

Content and Audience Dynamics

Linear TV is not becoming obsolete. It’s strategically reinventing itself.

The platform is leveraging:

- High-quality, targeted content

- Advanced measurement technologies

- Audience-based buying strategies

- Cross-platform marketing integration

Smart marketers must:

- Dynamically adjust ad rates to match audience size

- Explore precise audience targeting

- Invest strategically in complementary digital platforms

- Utilize Connected TV (CTV) to bridge viewing gaps

Emerging Opportunities when adding CTV to overall video strategy:

- Personalized content delivery

- Sophisticated audience segmentation

- Integrated multi-platform advertising approaches

- Real-time performance tracking

Here’s an example from Nielson in the local Chicago market.

The chart above shows the Chicago HUT-PUT metrics for the age group 35-64 from 2012 to 2025. HUT (Households Using Television) measures the percentage of TV households in a given market tuned in to a particular program or station at a given time. PUT (People Using Television) measures the average number of people watching TV in a HUT household.

Key Takeaways:

- The PUT metric has been steadily declining over the years for this age group in the Chicago market. It starts around 800 in 2012 and drops to around 540 by 2025.

- The HUT metric also shows a downward trend, starting around 640 in 2012 and declining to around 549 by 2025.

- The seasonal patterns are visible. PUT and HUT values are higher during winter months (when people typically spend more time indoors) and lower values during the summer.

- The chart provides insights into the evolving TV viewing habits of the 35-64 age group in the Chicago market. As more entertainment options become available, TV viewership appears to be declining over time for this demographic.

- Marketers and advertisers can use this data to understand the changing landscape of TV consumption. Adjust your strategies accordingly, potentially exploring complementary digital channels to make up impressions and reach your target audience.

Television Insights for Marketers

To adapt, marketers must be strategic with their media placements, explore audience-based buying, and invest in complementary digital platforms. Linear TV is evolving, not disappearing, as it embraces advanced measurement, targeted content, and integrated marketing approaches.

Unlocking the Power of Connected TV: Strategic Insights for Brands

Connected TV (CTV) Consumption and Spending on the Rise

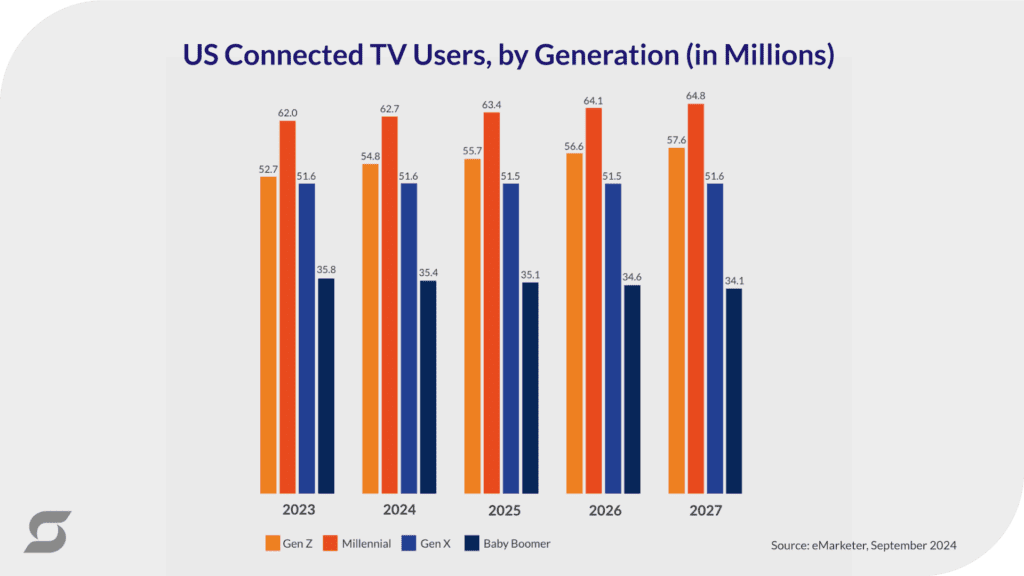

The shift towards CTV platforms shows no signs of slowing down. Consumers, especially younger generations, are increasingly abandoning linear TV in favor of ad-supported streaming services.

The U.S. is experiencing a surge in CTV ad spending, which is expected to surpass $32 billion by 2025 (eMarketer 2024). It’s also fueled by the rise of programmatic advertising, enhanced targeting capabilities, and the expansion of ad-supported options on popular streaming platforms like Netflix and Disney+.

Key Connected TV Trends to Watch

Ad-Supported Streaming Explosion

The launch of ad-supported tiers on major streaming services is dramatically increasing the available CTV ad inventory. This shift creates more affordable, accessible opportunities for brands to reach a wider audience with their messaging within premium streaming content.

Programmatic Targeting Takes Center Stage

Programmatic advertising in the CTV space will continue to grow. Brands can automate ad purchases, optimize targeting, and make real-time adjustments. Data-driven targeting allows advertisers to precisely target specific households, ensuring their ads are more relevant and effective.

Measurement and Attribution Advancements

Historically, the lack of standardized metrics and fragmented viewing habits across devices have made it hard to accurately measure the impact of CTV campaigns. However, huge advancements in cross-platform measurement tools and unified reporting are changing that. Advertisers can better assess the performance of CTV and compare delivery to linear TV and other digital channels.

The Connected TV landscape is evolving at a rapid pace, presenting both opportunities and complexities for savvy marketers. By staying attuned to these key trends, brands can capitalize on the surging CTV viewership and advertising potential.

Cracking the Connected TV Code: Navigating the Complexities 2025

The CTV ecosystem remains highly fragmented. Audiences spread across numerous streaming platforms like Netflix, Hulu, Disney+, Peacock, and Roku. Each platform offers different ad formats, pricing structures, and audience demographics. So it’s challenging for advertisers to plan and execute unified campaigns across multiple services.

Savvy advertisers are adopting holistic media planning strategies. They’re integrating CTV with traditional and digital media buys, often partnering with ad tech providers or demand-side platforms (DSPs) that offer unified access to multiple streaming services through programmatic buying. This helps streamline campaign execution, reducing complexity, audience overlap, and frequency challenges.

Measurement Obstacles in the TV Landscape

Another ongoing issue is the lack of standardized, cross-platform measurement tools. Traditional TV has long relied on Nielsen ratings, but CTV, while highly measurable via platform capabilities, lacks a unified system across different platforms and devices. As a result, advertisers struggle to accurately assess the performance of their CTV buys, making it difficult to gauge true reach, overlap between linear and streaming, and to optimize their investments accordingly.

To address this, advertisers are partnering with third-party measurement providers or platforms that actively work to improve holistic TV measurement and cross-channel analytics. Utilizing first-party data and advanced analytics to track user engagement and conversion metrics can help bridge the gap. Additionally, employing incremental lift studies provides valuable insights into the true impact of CTV campaigns.

Embracing the Evolving CTV Landscape

As the CTV ecosystem continues to transform, it presents both challenges and opportunities. Smart marketers will adopt holistic strategies, leverage emerging measurement solutions, and stay curious about the latest industry developments. Brands can successfully harness the power of CTV to drive meaningful engagement and measurable results for business growth.

Unlocking the Power of Ad-Supported CTV: The Future of Video Advertising

As the streaming landscape evolves, one thing is clear: ad-supported tiers are poised to play an increasingly vital role. As of Q1 2024, 38% of U.S. premium video-on-demand (VOD) subscriptions were ad-supported. That’s a significant jump from just 31% in Q2 2023.

The trend reflects a growing consensus among consumers. Ad-supported options offer an appealing compromise between cost savings and content access.

The Rise of Ad-Supported CTV

Major streaming services are now offering ad-supported tiers. Thus, we expect substantial growth in 2025 in the U.S. CTV advertising market. In fact, eMarketer projects that by 2028, CTV ad spending will account for nearly 50% of total TV ad expenditures, on par with linear TV.

The Ascent of FAST Services

Fueling this expansion are the increasingly popular free ad-supported streaming television (FAST) channels. These linear TV-like experiences are offered by Pluto TV, Crackle, The Roku Channel, Freevee, Tubi, and more. They allow viewers to enjoy streaming content without the burden of subscription fees.

As consumers become more selective about which services they’re willing to pay for, FAST channels provide an attractive alternative. They’re tapping into the growing demand for streaming-based advertising.

Linear TV vs. Streaming in the Media Ecosystem

Linear TV Dominance in Ad Inventory

Despite the increasing popularity of streaming, linear TV continues to lead the way when it comes to generating ad time on TV screens.

In the second quarter of 2024, nearly 90% of the time viewers spent watching ads on TV screens was attributed to linear TV, a result of its significantly higher ad load compared to streaming platforms.

Viewing Patterns Are Shifting, But Linear TV Still Leads

In 2020, linear TV accounted for 72.2% of the time US viewers spent watching video on TV screens. By the end of 2024, this figure is forecasted to drop to 56.5%.

While streaming continues to grow its share of viewing time, linear TV remains a crucial component of the media ecosystem, particularly for advertising exposure.

Takeaway

Although streaming continues to grow in viewership and revenue efficiency, linear TV remains the primary source of ad exposure due to its higher ad loads and larger inventory.

The rise of ad-supported streaming platforms adds diversity to the advertising landscape. However, it hasn’t yet matched linear TV in overall ad volume. Both mediums offer unique strengths, making them valuable components of a well-rounded media strategy.

Conclusion

Success in the evolving media landscape isn’t about a CTV vs. linear TV mindset. It’s about integrating both into a holistic marketing strategy.

As consumption habits shift, advertisers must adapt. Staying informed on trends allows marketers to allocate resources effectively, ensuring campaigns reach the right audience across platforms. Leveraging a mix of linear TV and CTV allows brands to maximize reach, optimize targeting, and drive better results in an increasingly fragmented space.

Get in touch today to learn how Scale Marketing can help you achieve your business goals and stay ahead in the competitive marketing landscape.